Home Affordability Calculator

The most popular form of investment in America is real estate. However, when investing in a home, it is not advisable to max out on your income and savings. This is why it is important to use a House Affordability Calculator. In order to avoid investments from turning into a financial issue, it is crucial to make sure that you have enough room in your budget to accommodate emergencies and unexpected expenses.

While buying a home, it is important to also consider retirement savings, planning for any children, potential home improvements, and your hobbies. Mortgage payments go on for many years, so the amount that you are committing to pay on a monthly basis should be around 28% of your monthly take home income. So, if you happen to be wondering “how much house can I afford?”, you need to follow the 28/36 rule.

This free House Affordability Calculator is built on the 28/36 rule to help you make a wise and well-informed financial decision.

What is the 28/36 Rule of House Affordability?

The 28/36 rule is used to calculate the overall debt that an individual or household can afford to undertake. Most mortgage lenders and other creditors use this rule to determine an individual’s borrowing capacity.

Most financial advisors agree that an individual or household should not spend more than 28% of their gross monthly income on housing expenses and no more than 36% on their overall monthly debt. The overall monthly debt includes expenses like your credit card payments, car payment, student loan, etc.

The 28/36 rule is tried-and-tested. Loan debts that exceed this rule tend to be heavy on the individual’s pocket and most often lead to default.

Why Use a Home Affordability Calculator?

This Home Affordability Calculator is based on income and gives you an idea of how much money you need in order to purchase a home. The calculator determines how much home you can afford after taking taxes, your preferred loan term, DTI, market interest rate, etc into account.

When purchasing a home it is important to always think about your future. Think about retirement and also about having a comfortable lifestyle before you retire. Your mortgage should not have to make you cut back on family holidays, buying a new car, or anything else that you might want to do in the future. Also, it would be wise not to stretch your mortgage payments too much. In case a need for home improvement, renovation, or any emergency modifications arise in the future you may not be able to accommodate it in your budget.

Use this House Affordability Calculator (with taxes) to estimate how much your monthly payments will be.

How to Use the Simple House Affordability Calculator?

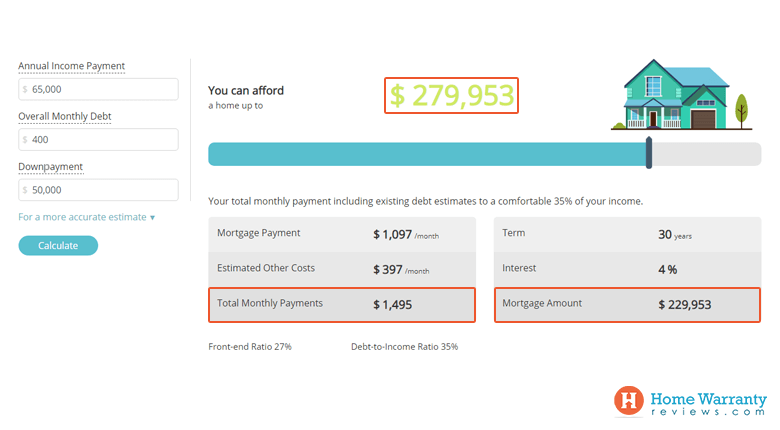

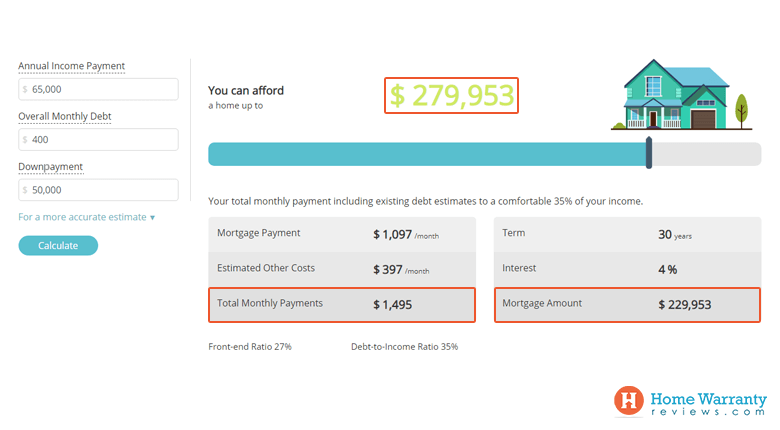

Our House Affordability Calculator has two parts to it: the simple calculator, and the advanced calculator that is displayed when you click on “for more accurate results”. The simple House Affordability Calculator requires you to key in three basic details:

- Annual income

- Monthly debt

- Down payment percentage, or amount

After you enter this information, hit “Calculate”. The Home Affordability Calculator estimates the house price that you can afford, your total monthly mortgage payments, and the mortgage amount.

How much house can I afford?

The amount of money for which you can afford to buy a home will be mentioned in bold and in the middle. The color in which the amount is displayed tells you how easy or difficult you will find it to make your monthly payments or to qualify for a mortgage.

The House Affordability Calculator calculates this amount by adding how much mortgage you can afford, to the down payment that you can make.

If your DTI ratio is 35% or lower the home affordability amount will be displayed in green. This indicates that you can easily afford to buy a home at this price. Your monthly payments will not be too heavy on your budget.

If your DTI ratio ranges from 36% to 42% the home affordability amount will be displayed in orange. This means that you can get a mortgage on these terms, however, we recommend keeping your DTI below 36% to avoid financial burdens.

Once your DTI touches 43% the home affordability amount will be displayed in red. Your monthly payments will be too stretched with a DTI this high. You may be able to get a mortgage from some lenders. However, we highly recommend that your DTI does not exceed 36%.

Your total monthly payment:

Your total monthly payment consists of your mortgage payment along with other estimated costs. The estimated “other” costs include your property tax, home insurance, and any HOA or condo fees. These expenses are often neglected when buying a home. We tend to be so focused on the mortgage payments and interest rates that these expenses are overlooked.

Our Home Affordability Calculator estimates these extra costs to ensure that you are fully aware of the out-of-pocket expenses that you will face when buying a home.

How Much Mortgage Can I Afford?

This amount is given in the table beside your “Total Monthly Payments”. Your mortgage affordability is estimated based on your gross annual income, your current overall monthly debt, interest rate and a few other factors. If you can afford a large mortgage, you can afford a more expensive home and vice versa.

A higher mortgage will have higher monthly payments while a lower mortgage amount means lower monthly payments. Your estimated “other” costs also tend to increase when the house price increases.

If you find your monthly payments too high, adjust the slider to reduce or increase your payments. Along with a change in the payments, your DTI will also change. Sliding the bar to the right will increase your monthly payments, your house budget and DTI as well. Moving the bar to the left will reduce all the three values.

For a more accurate estimate, you can use the advanced calculator which consists of a few more fields.

The Advanced Home Affordability Calculator

This has 6 extra fields that help you arrive at a more reliable estimate that the simple calculator as it considers less data.

Debt-to-Income

You can enter the DTI that you are comfortable with committing to. The calculator will provide you with an estimate of the home price that you can afford ensuring that your DTI does not exceed your preferred percentage.

It is important to note that your DTI includes all your monthly debts, credit card payments, and other loans.

Interest Rate

Our Home Affordability Calculator includes the interest rate that is trending in the market. However, if you have a pre-qualified loan, you can enter the interest rate for the estimate to be more precise.

Loan term

Most homeowners prefer a 15 or 30-year term when they purchase a home. However, you can enter your preferred loan term depending on what you are comfortable with. Shorter mortgage terms mean you pay less in interest.

Property Tax

The simple House Affordability Calculator includes estimated property taxes. Your property tax includes an annual tax on your property or the home. The tax amount is based on the home's value. You can change the property tax depending on the state in which you live in order to ensure the accuracy of the other costs involved in buying a home.

Home Insurance

If you are aware about the approximate monthly home insurance amount, even better, you can change that as well. You will need home insurance as it protects your home from damages that are caused by fires, lightning, burglary, vandalism, storms, and explosions (depending on the insurance that you have opted for).

HOA or Condo Fees

Your HOA or CondoFees is a monthly amount that you will need to pay to your homeowners association. If the HOA fees or Condo fees in the locality are higher, you can edit the value on the calculator.

In case you are not aware of any of these values, don’t worry, our calculator provides you the estimated costs.

Factors that Affect Home Affordability

Getting yourself a low-interest rate can help you save tens of thousands of dollars over the term of the loan. Remember that mortgages typically have 15-year or 30-year terms. When you pay lower interest rates it gives you more money to spend and make huge purchases like a home or a car.

The quicker you can lock in a lower rate, the less you will spend on your mortgage payments. A lower interest rate helps you save up to thousands of dollars over your mortgage term.

How to Get a Lower Interest Rate on Your Mortgage?

Let's compare a 0.8% change in interest for a 15-year and 30-year mortgage term.

15-year mortgage term

With an interest rate of 3.5% your total payable is $321,697 while your total payable for the same mortgage amount would be $339,665 if your interest rate is 4.3%. Your total savings with a 0.8% change in interest rate is $17,968.

30-year mortgage term

With an interest rate of 3.5% your total payable is $404,140 whereas your total payable would be $445,384 for the exact same mortgage amount when your interest rate is 4.3%. Your total savings are $41,244 with just a 0.8% change in interest rate.

This means that your interest rate can make a huge difference if you have a long mortgage term.

How Does a Lower Interest Rate Affect Your Total Payable?

| Term |

Mortgage Amount |

Total Payable |

Savings |

| Interest Rate @ 3.5% |

Interest Rate @ 4.3% |

Interest Rate @0.8% |

| 15 years |

$250,000 |

$321,697 |

$339,665 |

$17,968 |

| 30 years |

$250,000 |

$404,140 |

$445,384 |

$41,244 |

Term

Mortgage Amount

Total Payable

Savings

Interest Rate @ 3.5%

Interest Rate @ 4.3%

Interest Rate @

0.8%

15 years

$250,000

$321,697

$339,665

$17,968

30 years

$250,000

$404,140

$445,384

$41,244

If you save $17,968 on your mortgage you could use that money to pay off your student loan sooner and reduce your overall debt. You could also invest it in tax lien certificates which are fixed-rate securities and pay double-digit interest rates. While if you saved $41,244 on a 30-year mortgage, you could even consider adding it to you retirement fund or going on an international family trip.

High credit scores, low debt, and a sizable down payment can all help you get a better interest rate and save more money on your mortgage.

Credit Score

It is important to check your credit score and to review your credit report for any false information before you start applying for a mortgage. You can get a free credit review from some companies online.

View your report and check for any inaccurate information and negative remarks. If you find any inaccurate information report it to the credit reporting agency immediately.

Debt-to-Income

Your Debt-to-Income (DTI) examines your monthly income against your monthly debt. When calculating your DTI, all your debts are considered. This could be your mortgage payments, student loan, personal loan, auto loan, credit cards, child support and other monthly debt. A DTI ratio of 20% or below is considered excellent.

The Federal Reserve considers DTI rates of 40% or more as significant financial stress. Every lender sets its own DTI ratio requirement. Lenders also consider that the front-end ratio should not be more than 28% while the back-end ratio or DTI should not be more than 36%.

The front-end ratio and back-end ratio play a significant role in determining the interest rate of your loan.

The front-end ratio determines the percentage of your gross income that goes towards your housing expenses. It includes your monthly mortgage payments, property tax, homeowners insurance, and homeowners association dues.

The back-end ratio (or DTI) is the portion of your income that covers all your monthly debt and obligations. It includes all the debt in your front-end ratio as well as all other monthly debts. This includes your housing expenses along with credit card bills, auto loans, child support, etc.

How to Check Your DTI Ratio?

To check your DTI ratio enter all your debt payments and divide it by your monthly gross income. Then multiply the result by 100 to get your DTI percentage.

DTI = (Total Monthly Debt Payments / Gross Monthly Income) * 100

Here’s an example on how to check your DTI ratio

Christopher’s monthly bills and income are:

- Mortgage: $1000

- Car loan: $500

- Credit card: $500

- Gross monthly income: $6,000

Christopher’s monthly debt is $2,000 i.e. Mortgage ($1,000) + Car loan ($500) + Credit card ($500)

Christopher’s DTI ratio is $2,000 ÷ $6000 [overall debt ÷ Gross monthly income]

His DTI ratio is 33%, which is below the recommended 36%

How to lower your DTI Ratio?

Keep track of your spending, including all your expenses be it big or small. Always pay down your debts, popular ways to pay down your debts include the snowball and avalanche method.

Let's take a look at how you can lower your DTI ratio:

- The snowball method requires you to pay your small credit balance while making a small payment to the others such as your car loan or personal loan.

- The avalanche method requires you to tackle accounts based on higher interest rates.

- Once you are done paying down the balance of debt that has a higher interest rate, you move to the second-highest rate and so on.

- Lower your credit card interest rates. Call your credit card company and see if they can lower the rate. If you pay your bills regularly the credit card company is more likely to reduce your interest rate.

- Don't make large purchases on your credit cards. Avoid taking new loans as your DTI score will go up and it can also affect your credit score.

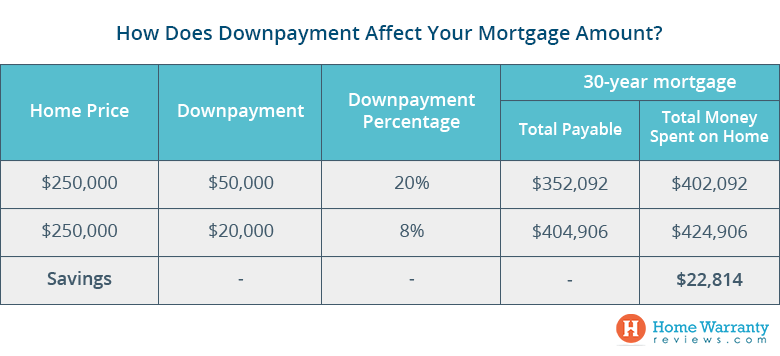

Down payment

Down payment is the up-front cash payment that you make before you buy a house (in this case). Your down payment is deducted from the total cost of the house and represents your ownership in the house.

Higher down payments have better mortgage rates because lenders risk less money. Your loan-to-value ratio (LTV) is taken into account for your down payment. The higher the down payment, the lower your LTV which in turn means less risk for the lender.

If your down payment is not very large but you want to buy a home you can choose a lower rate provided market conditions are in your favor.

Additionally, a larger down payment can also reduce the total payable on your mortgage.

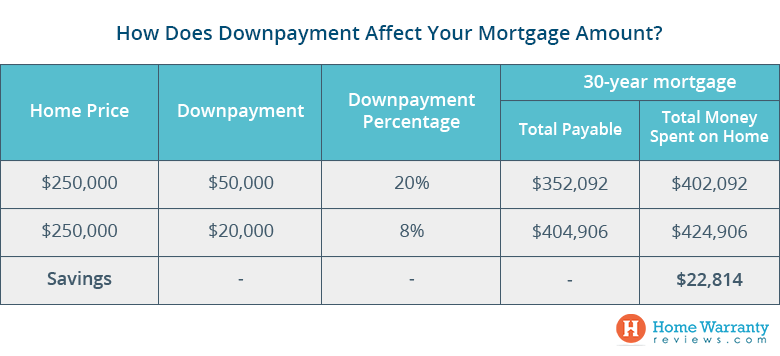

How Does Down Payment Affect Your Mortgage Amount?

Home Price

Down payment

Down payment Percentage

30-year mortgage

Total Payable

Total Money Spent on Home

$250,000

$50,000

20%

$352,092

$402,092

$250,000

$20,000

8%

$404,906

$424,906

Savings

-

-

-

$22,814

Let’s analyze buying a home that costs $250,000 that has an interest rate of 4.2% in two scenarios‒ when you pay a larger down payment and when you pay a smaller down payment.

When your down payment is $50,000 (i.e. a 20% down payment), your total payable will come up to $352,092. The total money you will spend on your home (down payment + total payable) will amount to $402,092. However, if you pay $20,000 (i.e. 8% down payment), your total payable will be $404,906 and the total money spent on your home will be $424,906.

You will save $22,814 if you can pay a down payment of 20% when compared to an 8% down payment. If you are not in a hurry to buy a home, saving money for a year before you buy a home can help you increase your down payment and further reduce your financial burden as your monthly payment amount also decreases.

Another important point as we mentioned earlier is that mortgage lenders offer lower interest rates when the down payment is substantial. This means that you will save additional money (not just $22,814) on the home as your interest rate will also be lower.

For many first time home buyers, the government and needs-based down payment programs are available with zero or low down payments.

What’s Next in the Home Buying Process?

Once you have finalized your home’s budget, you will need to find a house that you can make a home and also get a prequalified loan.

A prequalified loan is an initial start in your home purchasing journey. The lender will perform a credit check and you will need to fill out a mortgage application. If your prequalification loan is approved you will receive a pre-approval offer that is valid for 90 days. Prequalification also gives you an opportunity to work with your lender and get the right fit for your home.

While searching for a prequalified loan, don’t forget to use our Mortgage Calculator to compare different interest rates. Our interactive mortgage calculator gives you your monthly mortgage payments as well as a break up of your principal, interest and the total payable amount.

Should You Consider a Home Warranty?

While home insurance is more popular among homeowners and home buyers, there is another concept known as home warranty. Very often sellers and realtors add a home warranty while closing the deal with customers.

Home warranties cover the cost of repairs and replacements of home systems and appliances that occur due to everyday wear and tear.

In case you are not getting a home warranty along with the home you are buying, it is advisable to buy a home warranty plan if the appliances and systems in the house are over 4 years old. If the manufacturer’s warranties are still in place, you won’t need to consider buying a home warranty contract.

Mortgage payments being added to your monthly expenses takes away some amount of flexibility from your budget. In a case where an expensive home system or appliance breaks down, you’ll need to shell out additional money on the repair or replacement of parts. This is where having a home warranty helps you.

While closing the deal, it might be a good idea to ask your realtor if the home comes with a home warranty. Happy home buying!