Last updated: January 12th, 2024

Last updated: January 12th, 2024

Unlocking Financial Clarity: The Benefits Of Using A Mortgage Calculator

Purchasing a home marks an exciting milestone in life, often accompanied by many financial decisions. Among these decisions, choosing the right mortgage is one of the most critical.

In America, 35% of homes are rented while 65% are owned, with most homeowners acquiring their properties through mortgages. However, according to a survey involving 2,000 respondents (73% of whom were homeowners), only half knew the correct mortgage definition. Merely 49% could accurately identify the term, and renters fared even worse, scoring just 40%.

This article attempts to resolve the widespread confusion and emphasizes the critical need for a solid grasp of this essential aspect of managing finances.

What Is Mortgage? How Mortgage Calculators Help In Financial Planning?

A mortgage is a loan agreement to buy or keep up a house, land, or other real estate. The borrower consents to repay the lender gradually, usually by making several consistent installments that are split between principal and interest. Then, the asset is used as security to get the loan.

A complex math formula calculates monthly installments for a specific mortgage loan amount. But not everyone’s a math prodigy, right? Lucky for us, we have mortgage calculators to be our savior.

Considering several aspects, a mortgage calculator can be an effective tool for determining the type of home that suits your budget. You may enter necessary information such as the length of the mortgage, interest rate, down payment, and if you want to include extra expenses like taxes, fees, or insurance in your monthly payments with this handy tool.

The calculator produces results that show a thorough breakdown of your payments after you enter these figures. It splits the money used for interest from the portion that reduces the initial principal amount you borrowed.

Remember that different things affect interest rates. Longer-term loans often have higher interest rates, and those with lesser credit scores may also have higher rates. Your understanding of these subtleties facilitates educated selections about your mortgage options.

Impact Of Interest Rates

Mortgage interest rates greatly influence the long-term cost of financing a house. Mortgage borrowers aim to obtain the most affordable mortgage interest rates. Mortgage lenders, on the other hand, have to control their risk by setting interest rates. Only those with the best credit histories qualify for the lowest mortgage interest rates.

Key factors affecting mortgage rates include the economy’s growth rate, inflation, housing market conditions, the bond market, and the Federal Reserve monetary policy.

Prediction Of Uncertain Situations

There’s a widespread perception that some mortgage products are intrinsically dangerous because of their connection to the housing crisis. However, not all mortgages are dangerous, particularly if they properly fit the borrower’s financial situation.

The danger is when a borrower takes on a mortgage that exceeds their capacity to repay it. Certain mortgage products were matched with the incorrect borrowers during the financial crisis of 2008. The prospect of refinancing options, which may have sounded advantageous during an upturn in property prices, lured them in from lenders. However, this tactic backfired as real estate prices began to drop.

The adjustable-rate mortgage (ARM) is a risky alternative for people with less secure financial conditions. ARMs can carry greater risk due to variable interest rates, mainly if borrowers are unprepared for future rate increases.

Navigating mortgage alternatives requires understanding these subtleties. This helps borrowers choose solutions that fit their financial situation and lower their chances of repayment difficulties.

Why Use Homewarrantyreviews.Com Mortgage Calculator?

Built with a focus on user experience and functionality, our mortgage calculator aims to make navigating the world of mortgages a breeze. It empowers decision-making without overwhelming you with technical jargon or unnecessary complexities.

Let us learn more about its features:

- Visual Simplicity: The calculator’s display is designed for clarity and readability. The font size, color contrast, and overall presentation of numerical results are optimized for easy comprehension. By providing a clear and uncluttered display, the calculator ensures that users can easily read and understand their calculations at a glance.

- Instant Insights: Get ready for delight right away! Quickly crunching numbers, this calculator displays results in a flash. There will be no waiting—you will know immediately what your mortgage could look like.

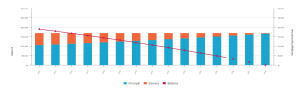

- Clarity: We’ve added an understandable bar graph as a result. The progressive increase and decrease in principal and interest rates over time are shown graphically in this graph. It’s similar to having a crystal ball for the future of your mortgage!

- The Universal Mortgage Rule: Our calculator ensures precision and dependability in your calculations.

It might be challenging to navigate the mortgage market, but with our mortgage calculator, you can access statistics, charts, and professional guidance. Take charge of your mortgage choices and go into homeownership with assurance!

Are you prepared to make the move? Visit the HomewarrantyReviews.com Mortgage Calculator to access a wealth of information on the financial planning of your ideal house!

How To Use The HomeWarrantyReviews.com Calculator?

An easy-to-use yet thorough method for weighing your mortgage options is the Interest Only Mortgage Calculator. The loan amount (often referred to as the principal), interest rate, and term duration are its three main input areas.

The calculator produces significant data like Interest Payable, Total Payable, and Monthly Mortgage Payment.

The principal and interest components are included in this tool’s monthly payment. All you have to do is enter the loan amount, interest rate, and term. That’s all! Quick calculations provide a comprehensive analysis that helps you make well-informed decisions.

Key Features Of The Calculator

Visual Display: Pie Chart With See-Saw

The See-Saw is a simple visualizer with a house and a piggy bank on either side. It depicts three possible financial situations:

Case 1: Home up, piggy bank down denotes a profitable investment in which savings outweigh interest payments.

Case 2: The home is down, and the piggy bank is up, indicating a less favorable investment and greater interest payments.

Case 3: Equitable Principal and Interest Payable, represented as a balanced see-saw oriented 180 degrees.

The Pie Chart: The pie chart, which is positioned beneath the see-saw, shows the monthly mortgage payment and the breakdown of the total amount owed into principal and interest contributions.

Amortization Schedule For Loans

Graph Shows the whole mortgage term; a bar corresponds to a year. It shows your mortgage payment plan from start to finish.

The table shows each year’s principal and interest payments, along with the total amount paid, the amount left, and the percentage of principal paid off.

The Detailed Payment Breakdown facilitates an analysis of the mortgage’s progress on an annual basis. It provides information on monthly breakdowns and your mortgage’s position at the end of the year. You may go down into the specifics of your mortgage payoff by clicking on various years, which causes the table to expand and show monthly data.

Essentially, our ‘Interest Only Mortgage Calculator’ explores every detail of your mortgage and offers a broad perspective. This tool allows you to make well-informed decisions regarding your mortgage journey, whether through examining the finer points or seeing the bigger picture.

Types of housing mortgage loans, their Pros & Cons

|

Loan Type |

Meaning |

Pros |

Cons |

|

|

|

|

|

Fixed Rate Mortgages |

With a fixed-rate mortgage, your monthly mortgage payment (principal and interest) will never change because the interest rate will remain constant for the duration of the loan. Most fixed loan periods are 15 or 30 years. However, some lenders allow you to choose a different duration. |

|

|

|

Adjustable-Rate Mortgages |

Adjustable-rate mortgages (ARMs) have variable interest rates instead of fixed-rate loans. You will often receive a cheaper, fixed introductory rate with an ARM for a predetermined period. Following this time, for the duration of the loan term, the rate fluctuates at predetermined intervals, either upward or downward. For instance, the rate on a 5/6 ARM is fixed for the first five years, and after that, it varies every six months until the loan is paid off, depending on the state of the economy. Your monthly mortgage payment increases in sync with an increase in your rate. |

|

|

|

Government Loans |

Although governments do not lend money for mortgages, they help more people become homeowners by supporting three primary kinds of mortgages:

|

|

|

|

These are home loans larger than conforming loan restrictions set by the FHFA. That refers to any debt in higher-cost areas that exceeds $766,550 or $1,149,825 in 2024. |

|

|

Benefits Of Early Repayment Of The Loan

Your loan payments are broken down into installments that cover both your principal balance and the interest rate. Although finance charges can add up rapidly, you can reduce them by paying more each installment than is necessary.

Such measures would reduce your payment balance sooner than the set time. But should you go for it? Let’s explore the benefits of repaying loans earlier than the maturity date:

A Reduction In Interest That Results In Savings

Repaying a debt early has several benefits, including lower interest costs. You will only be responsible for the interest on the loan balance’s early repayment. You will pay more interest overall if your payback time is longer. You can save significant money on interest payments if you have a shorter repayment plan.

A Higher Credit Rating

Your credit score is crucial because it indicates the likelihood of repaying your loan and how much interest you will incur. Your credit score will rise if you choose to repay your loan early. You will quickly get approved for a loan if your credit score is higher.

Your Monthly Budget Will Be Less Burdened

You can save money by paying more than necessary for your installment, which can help improve your financial circumstances. Since additional payments are allocated to the principal rather than interest charges, early payment will help you stay within your monthly budget.

The quick payments can be significant if you are struggling with other loans or payments. Your financial load will decrease when you pay off some of your bills. Make sure you reserve the excess funds for payments rather than using them for unneeded purchases.

The Chance To Obtain A Fresh Loan

Occasionally, it becomes infeasible to repay a loan in full within the allotted time, or you may need to take out a new loan with a different duration. By taking advantage of this chance to pay off your previous loan early, you may qualify for a better loan with more favorable terms.

Various Methods of Early Closure of the Mortgage

Early closure refers to paying off your mortgage before the initially scheduled loan term. This can help you save money on interest payments and achieve financial freedom sooner.

Here are various methods of early mortgage closure:

Making Extra Payments

- Additional Monthly Payments: Make extra payments towards your mortgage principal each month. Even a small additional amount can significantly reduce the overall interest paid over the life of the loan.

- Biweekly Payments: Make half your monthly mortgage payment every two weeks instead of monthly payments. This results in 26 half-payments or 13 total payments annually, essentially making one extra payment annually.

Lump Sum Payments

- Year-End Bonus or Tax Refund: Use any windfalls, such as year-end bonuses or tax refunds, to make a lump sum payment towards your mortgage principal.

- Inheritance or Gift: If you receive a significant sum, consider using it to pay your mortgage.

Refinancing

- Refinance To A Shorter Term: Refinancing your mortgage to a shorter term, such as 15 or 20 years, can help you repay the loan faster. However, be aware that this may increase your monthly payments.

- Refinance to a Lower Interest Rate: If interest rates have decreased since you took out your mortgage, refinancing to a lower rate can help you save on interest and pay off the loan sooner.

Recasting

- Loan Recasting: Some lenders offer loan recasting, where you make a large lump sum payment, and the lender recalculates your monthly payments based on the remaining balance. This doesn’t change the interest rate or term but can reduce monthly payments.

Accelerated Payment Plans

- Interest-Only Payments: Paying only the interest for a specific period can free up more money to make extra payments towards the principal.

- Graduated Payment Plans: Some mortgages have a graduated payment schedule where payments start lower and increase over time. You can pay more from the beginning to accelerate your mortgage payoff.

Automated Payments

- Automatic Increase: Set up automatic payments that increase annually with inflation or a fixed percentage. This ensures that you’re consistently paying more over time.

Selling and Downsizing

- Sell And Downsize: If your financial situation allows, selling your current home and purchasing a more affordable one can provide funds to pay off the mortgage or buy a new home outright.

Before implementing any of these methods, it’s crucial to check with your mortgage lender to ensure no prepayment penalties or fees associated with early repayment. Reviewing your mortgage agreement and consulting with a financial advisor can help you choose the strategy that best fits your financial goals.

Conclusion

In summary, adopting financial literacy via resources such as a Mortgage Calculator enables people to negotiate the intricacies of mortgage loans and homeownership successfully.

Making educated decisions is facilitated by knowing about different mortgage types and early repayment plans. Property owners can safeguard their financial future, avoid financial uncertainty, and establish a path toward solid financial health by becoming financially literate.

After all, stressing the value of continuing financial education guarantees a stable lifestyle and protects against financial hazards, ensuring a more promising financial future for everybody.

related articles

Discover First American Home Warranty Locations and What You Need to Know About Their Cover.

Discover First American Home Warranty Locations and What You Need to Know About Their Cover.

Reviews of Home Warranty Companies Show You How to Determine If Your Home Is Covered

Reviews of Home Warranty Companies Show You How to Determine If Your Home Is Covered