There are many types of mortgages and it is essential to understand the terminology and pick a mortgage that suits your situation. The prime factor that differentiates one mortgage from another is the interest rate; which is subject to market conditions. The interest rate for a mortgage ranges between 3.31% to 4.94% (based on the highest and lowest interest rates since 2013). However, if there are any events that drastically affect the market, the interest rates could go higher or drop lower.Choosing a mortgage that doesn’t suit your financial capacity could lead you down the wrong way. By mortgage, we mean a home loan. In the literal sense, the word mortgage only refers to the right to foreclose on a property in case the buyer is unable to make his/her monthly payments. Some of the preferred mortgages used to buy a home are:

Fixed-rate Mortgage or the Standard Mortgage

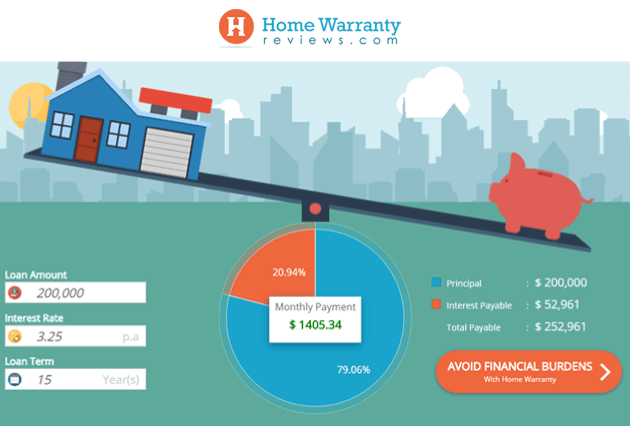

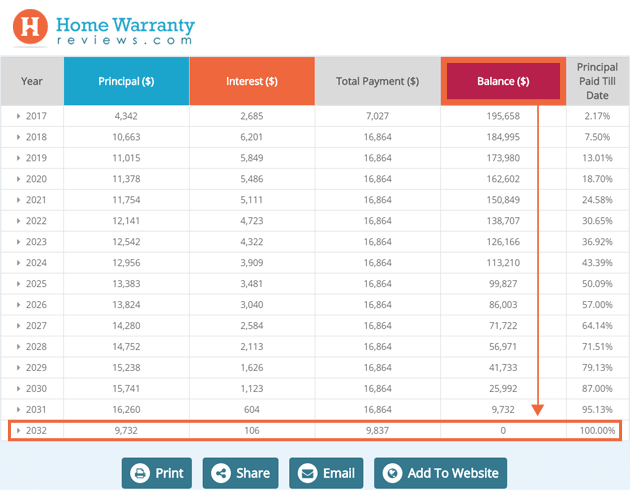

In a fixed-rate mortgage, you make the exact same payment throughout the term of the loan. The term may vary from person-to-person depending on their ability to repay the debt. In these mortgages, it is easy to calculate the monthly payment. The lender arrives at the monthly payment depending upon the loan amount, interest rate and the term of the loan.

Fixed-rate mortgages on an average are taken for a 15 or 30-year term/period. Sometimes, homebuyers pay more than their monthly payments and become debt free sooner.

Top banks offering fixed-rate mortgages: JP Morgan Chase, Bank of America, Wells Fargo, Citibank, etc. This is the most widely taken mortgage

Adjustable-rate Mortgage

These mortgages are similar to fixed-rate mortgages, but the interest rate is subject to change at some point in the future. Along with a change in the interest rate, even your monthly payment changes. If you have luck on your side, the interest rates could drop and reduce your monthly payment, but if it happens the other way round, your monthly payment will be higher. However, there are certain limits on how much the interest rate can move. Each time the rate changes, the lender recalculates the monthly payment. The risk factor that comes with this loan is that you don’t know exactly how much your monthly payment would be ten years down the line and whether or not you’ll be able to afford it.

Top banks offering adjustable-rate mortgages: Bank of America and Wells Fargo

Interest Only Loans

The name explains the loan. In an interest only loan, the homeowner only pays monthly interest on the loan. The monthly payment is small and the average term for these loans varies from 5-7 years. They’re available in both fixed-rate and adjustable rate mortgages. But the disadvantage is that you aren’t actually repaying your debt or building equity on your home. You will still have to repay the debt at some point in time. These loans are useful for short-term periods during financial instability.

Institutions offering Interest Only ARM: Union Bank, Bank of Internet USA, New American Funding, etc

Balloon Loans

Balloon loans require that the homebuyer pays off the loan with a large balloon payment at the end of the term. In these loans, there are no monthly payments. You will have to pay the entire debt amount along with the interest (the balloon payment) around 5 to 7 years down the line. These loans are good for temporary financing, but it is risky to assume that you will have access to that big a sum when the balloon payment is due.

Refinance Loans

These loans let you swap your mortgage for a new one if you find a better deal. When you refinance a mortgage, the new mortgage will pay off the old one. The costs involved in these loans can be high because of the closing costs involved. Typically homebuyers swap their adjustable-rate mortgage with a fixed rate mortgage.

Of all these above mortgages, fixed-rate mortgages are not only the most popular type of mortgages but they are also the safest mortgages. Most homebuyers who refinance their loans move to a fixed-rate mortgage as it is easier to pay off a mortgage that has a fixed interest rate and ensures that the principal amount as well gets paid off, thereby clearing the debt.

People also refinance their mortgages when they find a lender who is offering a lower interest rate. If you can save at least 1% to 2% by refinancing your mortgage, you should go ahead with it.